As a teenager, my father was a house painter. He started out as a “brush and roller guy”, climbing ladders and cutting in windows. But as his business grew, he caught the attention of commercial developers with large jobs like grocery store ceilings and outfield fences. These can’t be completed with old school tools; they require a sprayer.

I remember my dad walking me through his logic of whether or not to buy a commercial sprayer. I didn’t recognize it then, but he was explaining to me “Break-Even Analysis”.

Imagine an investment scenario where a commercial sprayer with all the attachments costs $6,000. And once you own one, you’re set to branch out into the outfield fence painting market. Your marketing research reveals that high schools and city park associations pay an average of $4 per foot to paint their fences from foul line to foul line. You also run the numbers to determine that your unit cost of fence painting including labor and material is $1.25 per foot. The question is: How many feet of fence do you need to paint to pay off your investment in the sprayer? Break even analysis can show you the answer.

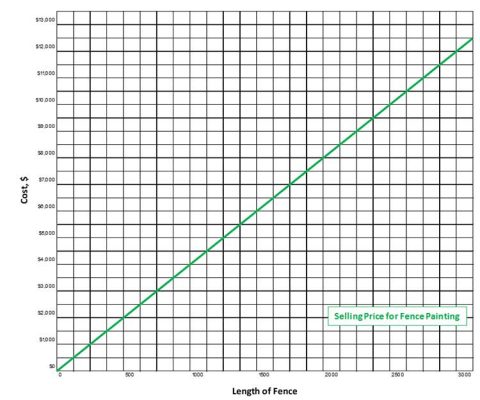

Let first consider the selling price of this painting service: $4 per foot. A typical high school baseball field has an outfield fence measuring 550 feet long. At $4 per foot, a competitive bid would be $2200. We could also write a formula to calculate the expected selling price of fence painting regardless of its length:

Bid Price = $4 * (Length of Fence)

Graphically, the expected selling price for painting a length of fence looks like this:

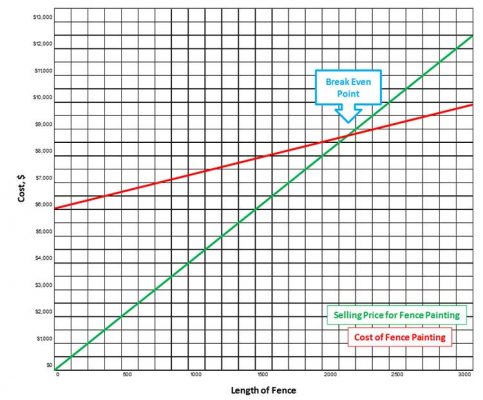

Now let’s consider the cost of fence painting. Before we can begin anything, we need to buy the sprayer at a cost of $6,000. After which, we can paint outfield fences at a cost of $1.25 per foot. Algebraically, we could write this as:

Cost of Fence Painting = $6,000 + $1.25 * (Length of Fence)

Notice both the cost of painting and the selling price of fence painting service can be expressed as a function of the length of fence. Graphically, we can plot these together:

Notice the intersection between the cost line and selling price line. This is the break-even point – the length of painted fence at which the total revenues equal total expenses. Stated differently, the break-even point is the length of painted fence at which the profits reimburse the business for the purchase price of the sprayer.

Since we know that the break-even point is where the Selling Price and the Cost are equal, we can calculate the break-even point with the following equation:

Selling Price = Cost

$4 * (Length of Fence) = $6,000 + $1.25 * (Length of Fence)

Solving the equation for “Length” yields a break-even point of 2,182 feet of fence. At 550 feet of fence per baseball park, this is about 4 parks. A quality commercial sprayer will last for several seasons before it needed any significant repair or replacement, so this investment is sizing up to be a good one.

The break-even point is an excellent starting point for understanding the value of an investment to your organization. In the next two articles, we’ll discuss the “Pay-back Period Method”, another back-of-the-napkin method for analyzing investment problems.

For a deeper dive into capital equipment justification, and to learn the essentials of business finance all managers need, sign up today for Return on Investment (ROI) Modeling and Analysis or Business Finance: A Complete Introduction.